Filing an insurance claim can lead to a stressful situation for home or business owners. Some property owners are unaware that they can hire a public adjuster for better claim handling and results.

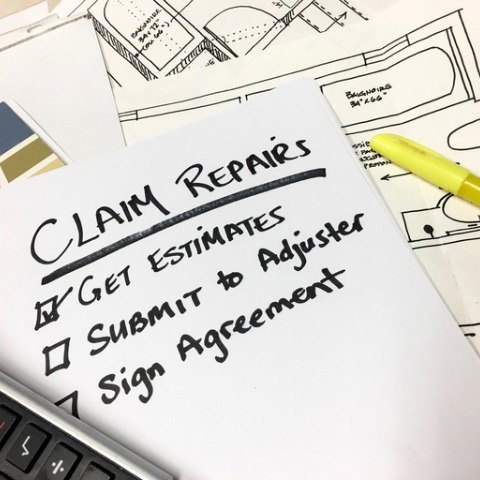

A property owner needs to understand what to expect when filing a property damage claim.

Once you file a claim, your insurer will send an adjuster. The adjuster's role is to check your property, assess the damage, and inquire about the cause.

They will also ask you about your property's condition before the damage occurred. You will be able to provide estimates from your research about the cost of repairing any damage. You will need to include this in a proof of loss document for your claim.

You should note that the adjuster works for the insurance company.

Hiring a public adjuster means getting an insurance claim expert who can provide the proof of loss paperwork for you. A public adjuster's detailed proof of loss report will speed up the entire process.

What happens next?

Once you submit your claim, another group from your insurance company will review the details. The insurance company will review your claim and may give you money to fix or replace your damage.

When you involve a public adjuster with your claim, you have an insurance expert on your side who will protect your best interests. A public adjuster can help settle disputes about the settlement value by negotiating with the insurance company.

A public adjuster can navigate any disputes and work on your behalf to reach a more successful outcome.

How are settlements paid?

The insurance company may give a check to the property owner and the mortgage service or lender for each claim. Most mortgage agreements require this to protect the interest of the lender.

You can also pay some portion of the settlement before repair work begins so you can hire a contractor. Checking for proper licenses and insurance is critical. Also, NEVER pay a contractor up front.

RELATED | Challenges you may face during an insurance claim

An experienced public adjuster will settle your claim faster than if you handle it alone. You will also get the settlement you deserve.

How long does it take?

Several factors determine how long it takes to settle a property damage insurance claim. The Consumer Finance Protection Bureau says the following items will affect the timeline.

- The extent of the damage

- Length of time before an adjuster arrives

- Whether there are any disputes on the value of the compensation for damages

- State laws may have specific deadlines to meet throughout the claim process

Your state's insurance department or insurance commissioner can provide additional information to help you understand those deadlines.

It isn't too late if you have reached this point and are not working with a public adjuster. You may still call a public adjuster to get help negotiating the value of your settlement.

Find a public adjuster.

If you need help with an insurance claim, find a licensed public adjuster with experience in handling claims. Sill Public Adjusters is the leading public adjusting firm in North America.

We have offices throughout the United States and Canada, which means we can respond to any location within hours.

Sill specializes in large commercial property claims to manufacturing facilities, farms, apartment units, government buildings, or schools. We have the experience to handle any damage claim to any building.

We also have a team of experts who can handle large residential property claims. The process can be complex for more significant claims, so hiring a public adjuster is the best way to reach a more successful outcome.

Sill is a unique company that helps with building damage, contents, and business interruption claims.

RELATED | What is a business interruption claim?

Sill has a team of licensed insurance adjusters who can handle property claims in almost 50 states. If you have experienced any damage, you can contact us 24/7 by calling 844.650.7455.

Public adjusters vs. Insurance company adjusters

Insurance claims usually involve an adjuster, who is almost always present, whether it's for property damage or other losses. Not all adjusters are the same.

Knowing the differences between public insurance adjusters and insurance company adjusters can greatly affect your claim's outcome. This article will explain the differences between insurance claims, clarify their roles, and help you make an informed decision.

Insurance Company Adjusters: The In-House Representatives

Insurance companies employ their own adjusters, often called "insurance company adjusters" or simply "in-house adjusters." These adjusters only work for the insurance company. They protect the company's interests when dealing with claims.

Public Adjusters: Advocates for Policyholders

Public adjusters are independent professionals who represent policyholders, not the insurance company. Their main job is to offer insurance help and support for the policyholder during the claims process.

They ensure the protection of the policyholder's rights. They also ensure that the policyholder receives a fair and proper settlement. The policyholder receives a fair settlement by understanding the complete insurance coverage. (Learn More)

A public adjuster is an insurance professional who assists with home, business, and personal property insurance claims.

Sill is the leading public adjusting firm in the industry. We handle any type of insurance claim, and our clients get the insurance settlement they deserve.

We handle homeowners insurance claims or commercial property claims.

Our team is available 24/7 at 844.650.7455.

SOURCE | Consumer Financial Protection Bureau