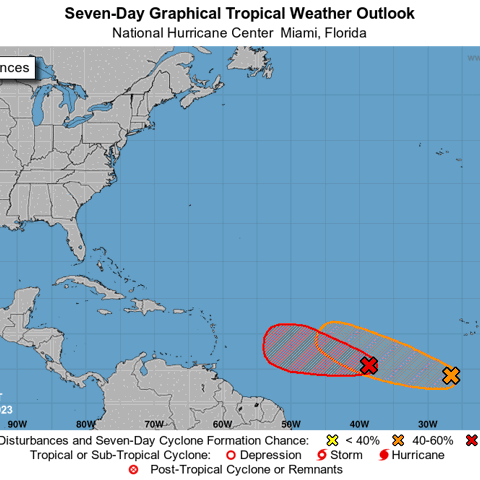

A tropical disturbance is expected to develop into a tropical depression or named storm later today. According to the National Hurricane Center, Invest 92L has a 100% chance of developing into a tropical cyclone.

Experts say this would be rare if the tropical cyclone develops this far east in June. Ocean temperatures are currently 2-3 degrees warmer than usual for this time of year, which is what is leading to favorable conditions for storm development.

Forecast models vary regarding where this storm may end up, but it is far too soon to know if it will impact the United States.

Hurricane season has already begun, so it is an excellent time to review your insurance policy and ensure you have a recovery strategy if you own a home or business that a storm may impact.

When it comes to protecting your property, the need for thorough hurricane preparedness cannot be overstated. The insurance claim process following a hurricane can be daunting, and many homeowners might find themselves unprepared for the bureaucratic and technical hurdles they face.

This is where a Public Adjuster's expertise can be invaluable. With strategic planning, comprehensive hurricane insurance coverage, and the support of a professional public adjuster, you can safeguard your property and ensure adequate compensation for any damages incurred.

Hurricane Preparedness: The Key to Protecting Your Property

Effective hurricane preparation starts long before the storm arrives. It's all about securing your property to mitigate damage.

-

Home Inspection: Hire a professional to inspect your home's structure, roof, windows, doors, and garage to ensure they're all in the best possible condition to withstand a hurricane.

-

Secure Windows and Doors: Consider installing hurricane shutters or, at the very least, having plywood ready to board up windows. Ensure doors have deadbolt locks and are well-sealed to prevent wind-driven rain infiltration.

-

Roof Maintenance: Reinforce your roof with hurricane straps or clips for better wind resistance. Regular maintenance and replacing loose or damaged shingles can help prevent further damage.

-

Secure Outdoor Items: Secure or store inside items that can become projectiles during high winds, like grills, furniture, and decorations.

-

Tree Trimming: Trim trees and shrubs around your home to minimize the chance of broken branches causing damage.

-

Flood-proof Your Home: If you live in a flood-prone area, consider installing flood vents or a sump pump. Elevating electrical appliances is also a wise measure.

The Importance of Hurricane Insurance Coverage

Comprehensive hurricane insurance coverage is another crucial aspect of preparedness. Your homeowner's insurance may not cover hurricane damage, especially in high-risk areas.

Evaluate your coverage: You might need additional windstorm or flood insurance policies. Make sure your coverage is adequate to replace your home and belongings if they are destroyed.

Understand your deductibles: Some insurance policies have separate deductibles for hurricane damage, which could be a percentage of the insured value of your home. Know what these are ahead of time to avoid any surprises.

Document your property: Regularly update your home inventory list with photos or videos. This documentation will prove invaluable when filing an insurance claim post-hurricane.

Unveiling the Role of a Public Adjuster in Insurance Claim Handling

Navigating the complexities of an insurance claim after a hurricane can be overwhelming, especially when dealing with the stress and potential displacement following a disaster. A public adjuster can be a game-changer. These are licensed professionals who work on behalf of the policyholder, not the insurance company.

-

Expertise: A public adjuster understands insurance language, policy coverages, and the claim process. They can help you accurately value your claim and ensure all damage, including hidden or longer-term issues like mold growth, is included.

-

Advocacy: Public adjusters represent your interests, not the insurance company's. They handle the time-consuming tasks of documenting the damage, estimating repair costs, and negotiating with the insurance company.

-

Maximized Claims: Studies show that policyholders who hire public adjusters often get higher settlements than those who don't. The additional compensation can far exceed the adjuster's fee, making them a worthwhile investment.

-

Peace of Mind: During such a stressful time, having a professional manage your claim can provide emotional relief, freeing you to focus on rebuilding and recovery.

The aftermath of a hurricane is already a challenging time. By preparing your property, understanding your insurance coverage, and potentially hiring a public adjuster, you can navigate the recovery process with more confidence and less stress.

With strategic insurance claim handling, you ensure your road to recovery post-hurricane is as smooth as possible.

Finding the Right Public Adjuster for Your Hurricane Insurance Claim

Having a skilled Public Adjuster by your side can significantly influence the outcome of your insurance claim. However, it's crucial to choose the right professional. Here are some tips to guide you in your selection process:

-

Check Licensure: Ensure the public adjuster is licensed to operate in your state. You can verify this information through your state's Department of Insurance.

-

Consider Experience: Look for an adjuster with a track record in hurricane damage claims. Experience in this particular area ensures they understand the nuances of such claims and can handle any issues that may arise.

-

Ask for References: Reputable public adjusters should be willing to provide references from previous clients. Reach out to these individuals to get a firsthand account of their experiences.

-

Review the Contract: A professional public adjuster will present a detailed contract before starting work. Before signing, ensure you understand their fees, services provided, and any terms or conditions.

-

Evaluate Communication: Good communication is crucial when handling insurance claims. Your public adjuster should be accessible, willing to answer your questions, and able to explain complex insurance terms understandably.

-

Avoid High-Pressure Tactics: Be wary of public adjusters who pressure you to sign a contract immediately following a disaster. A professional adjuster will respect your need to review the agreement and make a considered decision.

-

Check with the Better Business Bureau (BBB): Check the adjuster's standing with the BBB and research if any complaints are lodged against them. This will help you find out their credibility.

By taking the time to research and choose the right public adjuster, you increase the chances of a successful, satisfactory outcome with your hurricane insurance claim. An effective public adjuster can help you navigate the complex insurance landscape, reducing stress and ensuring you receive the compensation you're entitled to.

Sill is the leading public adjusting firm in the industry. The company has been in business for almost 100 years, and we represent hundreds of property owners each year. Our disaster response team will respond to any region affected by a storm within hours.

If you experience any property damage due to a storm, call Sill 24/7 at 844.650.7455.

SOURCE | NOAA.gov