Typically, most of my friends regard our business, insurance claims management on behalf of insureds, with resounding disinterest at best. My “day at the office” is generally low on the list of topics brightening a Saturday evening with friends and often simply disregarded altogether.

That was until 2020, the year of “What’s Happening Now and What’s Next?” Suddenly, and paradoxically for valid reason, phone calls, texts, emails and the contact form from Sill.com are streaming in at record levels - from the onset of COVID-19 to the protests that spawned looting and riots.

This is not a forum for rehashing the politics, science, prejudice and other intersecting factors resulting in the perfect storm of catastrophic imperfection. Suffice to say, nevertheless, we are eager participants in the battle against the pandemic virus and additionally share in the calls, make that cries, for equality and justice.

What has filled my working days is answering the question:

Are damages to businesses from the recent riots covered under property insurance policies?

In short, the answer is usually “Yes” without hesitation. Because Sill, the nation’s leading public adjuster, exclusively represents policyholders in property damage and loss claims, I will limit this discussion to damaged buildings, personal property and lost business income also referred to as Business Interruption (and exclude coverage with respect to damaged automobiles).

Rioting, civil commotion, and vandalism are all covered perils under virtually every business owners and commercial property “All Risk” and “Named Peril” policies. More specifically, under modern “All Risk” commercial policies, all risks of loss, except those specifically excluded, are covered by policies. Riots, civil commotion and vandalism are not generally excluded.

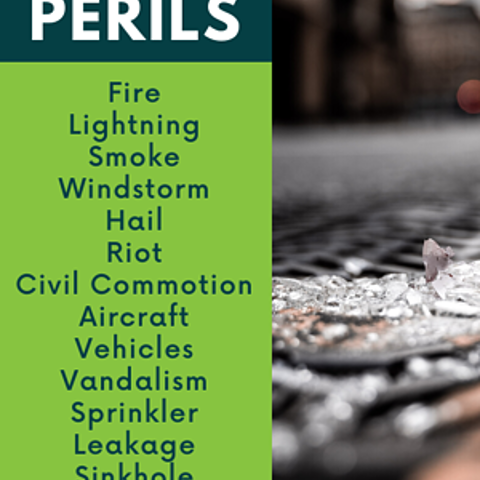

Additionally, “Named Peril” policies technically are captured on loss form CP 10 10, which provides coverage for the perils named in the chart to the right.

Damage to windows, doors, light fixtures and other building parts should be covered under the building property coverage included in the policy. It should be noted, however, that while glass is usually part of the covered property and built into the base rates as long as it is part of the building, it is possible that some policies will have special glass endorsements.

Damaged or stolen furniture, liquor, food, glassware, office supplies, computers, machinery, etc., basically everything except for the building itself, should qualify for coverage under the business owners’ business personal property coverage.

Many business/commercial policies also include coverage for Business Income loss, which is the economic loss or damage that a business incurs from a covered loss at the covered property. Also known as Business Interruption (BI), this would include coverage for extra expenses incurred by a business owner to continue operations while the insured premises are being repaired or replaced. Further, businesses forced to suspend operations or limit hours due to rioting, civil commotion or vandalism have coverage for the loss of income under the BI provisions of their policies. Note that BI coverage typically requires that a business incur “direct physical damage” to the premises before triggering coverage.

As the “devil is in the details” or as one insurance industry commentator has termed it: “RTFP - Read The Full Policy” what exactly is a “Riot” or “Civil Commotion?”

What is a riot?

A riot is defined by Black’s Law Dictionary, the most widely used law dictionary in the United States, as:

- An assemblage of three or more persons in a public place taking concerted action in a turbulent and disorderly manner for a common purpose (regardless of the lawfulness of that purpose).

- An unlawful disturbance of the peace by an assemblage of usually three or more persons acting with a common purpose in a violent or tumultuous manner that threatens or terrorizes the public or an institution.

What is civil commotion?

A civil commotion is defined as “a public uprising by a large number of people who, acting together, cause harm to people or property." Black’s Law Dictionary. To read more about defining these terms visit Merlin Law Group’s recent blog.

Thus, it is clear the damage to businesses we have all witnessed as a result of the riots or civil commotion, however you term it, is most likely covered by the insureds’ business owners policies. That is at least some solace to business owners who have already been racked by income losses stemming from the COVID-19 pandemic.

What’s next? Ideally not another calamity, whether forecasted as we also are in the beginning of the hurricane season, or unforeseen as were COVID-19 and the rioting. Hopefully, the future is more about financial recovery and rebuilding from the sustained losses as well as the prompt discovery of effective treatments for COVID-19 and injustice. The team at Sill is here to help in any way we can from reviewing policy coverage to filing and managing any property insurance claims that may be a result of these calamities. Contact our team today to take the next steps in the claims process.