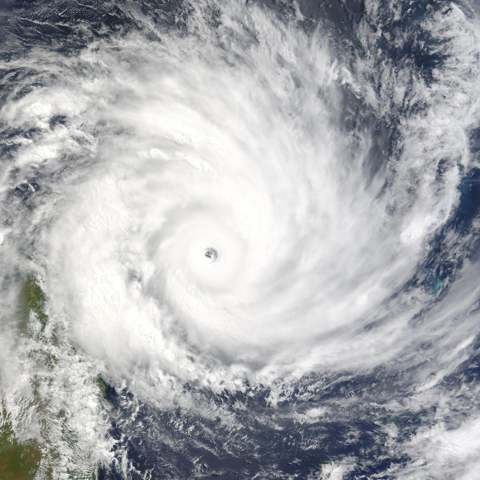

Forecasters are closely monitoring Tropical Storm Humberto in the central Atlantic as well as a separate, unnamed disturbance that could develop into a tropical system within the next week.

According to the National Hurricane Center's 5:00 AM AST advisory on Thursday, Sept. 25, 2025, Humberto is strengthening but remains far from land, with no watches or warnings currently in effect for the U.S. coastline.

This situation serves as a reminder for residents, especially those in Florida, to review their hurricane insurance and preparedness plans.

Current Status: Tropical Storm Humberto

-

Location: near 21.2°N, 56.4°W, about 480 miles ENE of the northern Leeward Islands

Movement: northwest at 10 mph with a gradual slowdown expected -

Maximum sustained winds: 45 mph, with forecast strengthening in the coming days

-

Minimum central pressure: 1007 mb

-

Tropical-storm-force winds extend outward up to 105 miles from the center

The National Hurricane Center notes that Humberto could continue to intensify as it moves northwest over warm Atlantic waters, potentially leading to hurricane-related damage claims in the future.

The Second System: Monitoring for Development

In addition to Humberto, forecasters are tracking a broad area of disturbed weather in the Atlantic basin. Although this system has not yet organized into a tropical storm, conditions may still allow for development over the next seven days.

Its future track, timing, and potential intensity remain uncertain. Still, the disturbance highlights the need for coastal residents to stay alert during the peak of hurricane season and review their property insurance policies.

What This Means for Residents

At this time, there are no evacuations or U.S. coastal warnings in place related to either Humberto or the second system. However, history shows that storms can change rapidly.

Residents across the Southeast and Gulf Coast should monitor updates from the National Hurricane Center and local emergency management officials, and consider reviewing their Florida hurricane insurance coverage.

How to Prepare Your Property for a Hurricane

Even if a storm is days away, hurricane preparedness is critical. Property owners can reduce potential losses by taking proactive steps before a hurricane makes landfall, which may help in future hurricane insurance claims.

-

Secure loose outdoor items such as furniture, grills, and trash cans.

-

Install storm shutters or board up windows to reduce breakage and water intrusion from wind-driven rain.

-

Reinforce exterior doors, particularly garage doors, which are highly vulnerable in high winds.

-

Trim trees and remove loose branches to prevent damage to roofs, siding, and power lines.

-

Clear gutters and storm drains to help water flow away from your home.

-

Safeguard important documents by storing them in waterproof containers or backing them up digitally.

-

Prepare an emergency kit with flashlights, extra batteries, first aid supplies, non-perishable food, water, and necessary medications for at least three days.

-

Review your property insurance policy and flood insurance policy to understand your coverage.

How to Handle an Insurance Claim After a Hurricane

Filing a hurricane insurance claim can be one of the most stressful parts of hurricane recovery. Taking the proper steps early on can make a big difference in the outcome and help avoid insurance claim disputes.

-

Document everything. Take detailed photographs and videos of the property damage as soon as it is safe to do so.

-

Save receipts. Keep all documentation for temporary repairs, lodging, or other emergency expenses.

-

Notify your insurer promptly. Report the loss to your insurance company to begin the claims process, and be aware of insurance claim deadlines.

-

Preserve damaged items. Do not discard property until it has been inspected or documented.

-

Track communications. Keep a detailed log of every conversation with your insurance company, including the date and names of all parties involved.

-

Be cautious with early settlement offers. Insurance companies may push for a quick payout that does not reflect the full scope of your damages.

-

Understand the difference between actual cash value and replacement cost coverage in your policy.

-

Prepare a detailed proof of loss document to support your claim.

How Sill Public Adjusters Can Help

Recovering after a hurricane is overwhelming, and storm damage claims are often complex. This is where Sill Public Adjusters makes a difference. We are the largest and most experienced public adjusting firm in North America, representing policyholders—not insurance companies. Our team of insurance adjusters specializes in hurricane and storm-related claims, helping clients maximize their settlements so they can rebuild faster.

Here's how Sill can support you:

-

Conduct a thorough review of your property insurance policy to identify all available coverages, including weather-related coverage.

-

Provide expert documentation of losses, including structural damage, contents, and business interruption coverage.

-

Manage all communication and negotiation with your insurance carrier, including handling supplemental claims.

-

Deploy specialists such as forensic accountants, engineers, and inventory experts to strengthen your claim.

-

Fight for the settlement you deserve while you focus on your family, employees, or community.

-

Assist with NFIP claims for flood-related damages.

-

Address complex issues such as anti-concurrent causation clauses in your policy.

-

Evaluate and claim for additional coverages like spoilage coverage and civil authority coverage.

-

Handle contingent business interruption claims for businesses affected indirectly by the storm.

When a storm strikes, having Sill Public Adjusters on your side levels the playing field against your insurance company. Our team has been helping policyholders since 1928, securing hundreds of millions of dollars in settlements nationwide.

For immediate assistance with hurricane damage claims, call Sill at 844.650.7455 or visit www.sill.com.

Why Preparation and Representation Matter

With multiple systems active in the Atlantic, now is the time to act—not after watches and warnings are issued. Preparation protects property, but expert representation protects financial recovery. Even a well-prepared home or business can suffer catastrophic losses, and navigating the claims process alone often leads to underpayment or denial.

By combining smart storm readiness with the support of experienced public adjusters, property owners can safeguard not only their safety but also their financial future.

Humberto's progress and the potential development of a second system serve as reminders that every hurricane season brings uncertainty—and that the best defense is preparation and professional advocacy in handling hurricane insurance claims.

Remember, your property insurance policy is a contract, and understanding its terms, including coverage for wind-driven rain and other specific perils, is crucial.

Don't hesitate to seek professional help when dealing with complex insurance claim disputes or navigating the intricacies of your coverage. With proper hurricane preparedness and the right support, you can face the storm season with confidence.

Hurricane Preparation and Insurance Tips: Key Information

Weather experts are tracking Tropical Storm Humberto in the central Atlantic and also keeping an eye on another unformed weather system that may turn into a tropical cyclone soon. On Thursday, September 25, 2025, the National Hurricane Center issued a 5:00 AM AST update stating that Humberto is intensifying but remains far from land.

There are no warnings or alerts for the U.S. coastline at this time. This serves as a timely reminder for individuals in hurricane-prone areas to review their hurricane insurance and assess their preparedness plans.

Storm Update: Tropical Storm Humberto

-

Location: close to 21.2°N, 56.4°W, about 480 miles east-northeast of the northern Leeward Islands

-

Movement: heading northwest at 10 mph, though it may slow down soon

-

Maximum sustained winds: 45 mph expected to grow stronger in the days ahead

-

Minimum central pressure: 1007 mb

-

Winds at tropical-storm strength span up to 105 miles outward from its center.

The National Hurricane Center says Humberto may continue to strengthen as it moves northwest across warm Atlantic waters. This could result in claims for hurricane-related damage.

Second System: Watching Potential Development

Forecasters are also monitoring another system in the Atlantic, in addition to Humberto. This area of unsettled weather hasn’t yet developed into a tropical storm. Over the next week, though, conditions might allow it to strengthen. Nobody knows for sure where it’s headed, how fast it will move, or how strong it could get.

Still, it serves as a reminder to people near the coast to stay prepared during hurricane season and check their insurance plans.

What This Could Mean for Residents

No evacuations or coastal warnings for the U.S. are currently active for Humberto or the second system. But storms can change fast, as history often proves.

People living along the Southeast and Gulf Coast should follow updates from the National Hurricane Center and local officials. They might also want to check their Florida hurricane insurance details.

Steps to Protect Your Property Before a Hurricane

Preparing for a hurricane is essential even if the storm seems far off. Homeowners can take proactive steps to reduce damage risks and assist with potential insurance claims later on.

-

Bring in or secure outdoor items, such as furniture, grills, and trash bins.

-

Install storm shutters or cover windows with boards to stop glass from breaking and water from rain from getting inside.

-

Strengthen exterior doors and garage doors since they can fail during strong winds.

-

Cut tree branches and clear loose limbs to avoid potential damage to roofs, walls, or power lines.

-

Clean out gutters and storm drains to allow rainwater to flow away from your house more effectively.

-

Protect vital documents by storing them in containers that prevent water damage or by creating digital copies.

-

Pack an emergency kit that includes flashlights, extra batteries, first aid items, sufficient food, water, and medication to last for three days.

-

Review your homeowners and flood insurance policies to determine what they cover.

Steps to Manage an Insurance Claim After a Hurricane

Dealing with a hurricane insurance claim can be tough. Starting off on the right foot can shape the results and help reduce problems with your claim.

-

Take photos and videos. Capture clear pictures or videos of all the damage to your property as soon as it becomes safe to do so.

-

Keep proof of spending by storing receipts to show costs from emergency fixes, places to stay, or other urgent needs.

-

Inform your insurance. Notify your insurance company about the damage to initiate the claims process. Stay mindful of any deadlines involved in your claim.

-

Hold onto damaged goods. Don’t discard ruined belongings until someone has inspected them or they’ve been documented.

-

Keep track of calls and conversations. Write down the date and the name of the person you spoke to at your insurance company.

-

Watch out for quick settlement offers. Insurance companies may want to settle quickly without fully covering your losses.

-

Know the terms in your policy. Understand how actual cash value differs from replacement cost coverage.

-

Create a clear and detailed proof of loss document to back up your claim.

How Sill Public Adjusters Can Help:

Recovering after a hurricane can be daunting, and dealing with storm damage claims can become complicated quickly. Sill Public Adjusters steps in to help make the process easier.

As the most prominent and experienced public adjusting firm in North America, we represent policyholders, not insurance companies.

Our insurance adjusters specialize in handling hurricane and storm claims, helping clients secure the best settlements possible to facilitate a swift and efficient rebuild.

Here is how Sill helps:

-

We review your property insurance policy to identify all available coverages, including those for storm damage.

-

We document losses with expertise, including damage to structures, personal items, and interruptions to business operations.

-

We handle all communications and negotiations with your insurance company, including managing any additional claims that may arise later.

-

We also have forensic accountants, building experts, and inventory specialists on staff who will strengthen your case.

-

Focus on your family, staff, or community while we work diligently to secure the settlement you deserve.

-

Help file NFIP claims to recover losses from flood damage.

-

Tackle complex policy details, such as anti-concurrent causation clauses.

-

Review and consider extras such as spoilage coverage or civil authority coverage.

-

Manage business interruption claims when storms impact your operations.

When storms hit, Sill Public Adjusters stands by your side to level the playing field with your insurer. Since 1928, we have helped policyholders secure hundreds of millions in settlements nationwide.

To get help right away with hurricane damage claims, call Sill at 844.650.7455 or check out www.sill.com.

Why You Should Prepare and Have Representation

The Atlantic is currently experiencing several active systems. Taking action is better than waiting for warnings or alerts. You can take several steps to protect your property by preparing, but expert representation also ensures your financial recovery is secure.

Even if a home or business is well-prepped, the damage from a hurricane can still be massive. Handling claims on your own can often result in receiving less compensation than you need or even having your claim denied.

By planning for storms and working with skilled public adjusters, property owners can protect their safety and financial stability. The progress of Humberto and the potential for another system to form highlight how unpredictable every hurricane season can be. The best approach involves staying prepared and getting professional help with hurricane insurance claims.

Keep in mind that your property insurance policy is a contract. It is essential to understand its terms, like coverage for wind-driven rain or other specific risks.

If you find insurance claims confusing or run into disputes, you should get expert advice. With solid hurricane preparation and reliable support, you can tackle storm season with greater peace of mind.